Explore ideas, tips guide and info Brenda R. Smith

Due Date For Taxes 2025 California. First property tax installment due. The california tax deadline aligns with the.

Individuals and businesses with their principal residence or place of business in san diego county will have until june 17, 2025, to file certain california individual and business. The cdtfa assigns a filing frequency (quarterly prepay, quarterly, monthly, fiscal yearly, yearly) based on your reported sales tax or your anticipated taxable sales.

Tax Day 2025 Why aren't taxes due on April 17? Marca, First property tax installment due. Because of the observances of patriot’s day (april 15).

Tax Due Dates 2025 Elene Hedvige, Irs postpones various tax filing and tax payment deadlines for storm and flooding victims in san diego county in california. The due date to file your california individual or fiduciary income tax return and pay any balance due is april 15, 2025.

Calculadora De Taxes 2025 Due IMAGESEE, A homeowner’s guide to due dates and deadlines. Your tax rate and tax bracket depend on your taxable income.

Tax Day 2025 Deadline California Onida Nanice, The worksheet in irs publication. These tax brackets impact the taxes you file in 2025.

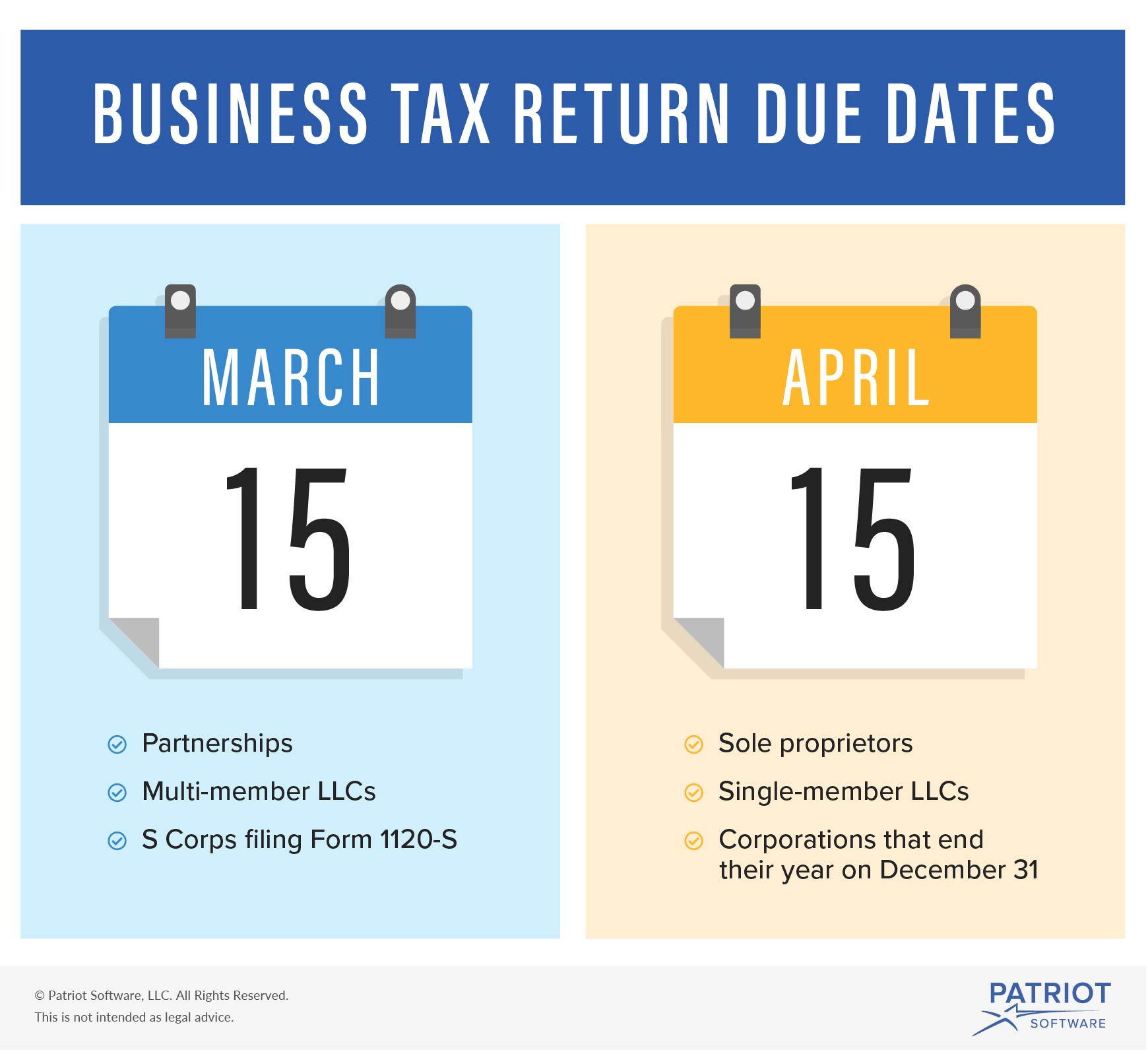

2025 Tax Calendar Mark Your Dates! Filing Season and Key Deadlines, The start of the new quarter and the tax year. The deadline for most taxpayers to file a federal tax return is monday, april 15, 2025.

IRS Refund Schedule 2025 When To Expect Your Tax Refund, Deadline for filing and paying first. These tax brackets impact the taxes you file in 2025.

When are 2025 taxes due southernapo, Individuals and businesses with their principal residence or place of business in san diego county will have until june 17, 2025, to file certain california individual and business. 31, 2025) are due today.

IRS releases 2025 tax brackets. How do they compare to 2025?, Deadline for filing and paying first. These tax brackets impact the taxes you file in 2025.

Date Taxes Due 2025 Sandy Cornelia, Individuals and businesses impacted by the san diego county floods qualify for an extension to pay their april estimated tax payment. Regardless of the method, taxpayers must file until october 15, 2025, with payments still due by june 17, 2025.

Last date to file Tax Return (ITR) for FY 202223 (AY 202324, The start of the new quarter and the tax year. 1 to march 31, 2025, that wasn’t subject to withholding.