Canada Pension Plan Rates 2025. We have already seen the only cpp increase that will occur in 2025. Cpp payment dates and amounts for 2025.

Canada pension plan increases are coming in 2025, meaning higher potential earnings in retirement—but also larger payroll deductions for employees. Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum contribution will be $3,867.50 each — up from $3,754.45 in 2025.

CPPIB To Launch Private Debt Platform In India Forbes India, The canada revenue agency (cra) recently announced significant updates to the canada pension plan (cpp), effective january 1, 2025, as part of phase. Canada pension plan and quebec pension plan rates.

Changes In The Canada Pension Plan CPP Rate Updates Retirement Canada, Additional federal tax for income earned outside canada; Canada pension plan increases are coming in 2025, meaning higher potential earnings in retirement—but also larger payroll deductions for employees.

Making the Most of Your Canada Pension Plan (CPP) National, Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum contribution will be $3,867.50 each — up from $3,754.45 in 2025. For 2025, the maximum cpp payout is $1,364.60 per month for new beneficiaries who start receiving cpp at 65, while the average cpp in october 2025.

What You Can Expect from CPP Survivor Benefits · 6 Point Wealth, Canada pension plan increases are coming in 2025, meaning higher potential earnings in retirement—but also larger payroll deductions for employees. Canada pension plan (cpp) contribution rates.

Benefits of Canada's Top Ten?, Canada pension plan increases are coming in 2025, meaning higher potential earnings in retirement—but also larger payroll deductions for employees. This is part of the cpp and oas.

PPT Service Canada Canada Pension Plan and Old Age Security, The amount will increase to cad 68500 for the canada pension plan (cpp), marking a significant rise from the previous cap of $66,600. While the average amount paid to new beneficiaries will fluctuate, the maximum cpp this year.

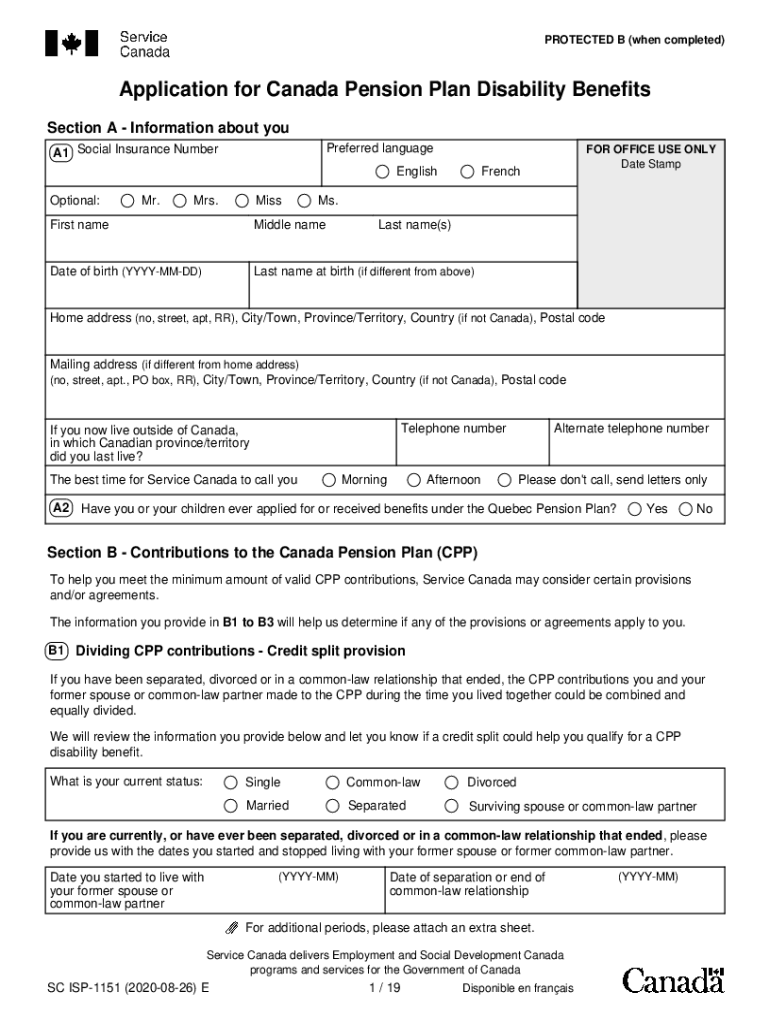

Printable Canada Pension Plan Application Printable Application, Canada pension plan and quebec pension plan rates. Canada pension plan increases are coming in 2025, meaning higher potential earnings in retirement—but also larger payroll deductions for employees.

Canada Pension Plan A good or bad investment? Cherry Chan, Chartered, If you are an employee, you and your employer will each have to contribute 5.95% of your. Cpp, or the canada pension plan, is a taxable benefit that substitutes part of your income when.

How changes to Canada Pension Plan benefits affect your wallet today, Additional federal tax for income earned outside canada; If you are an employee, you and your employer will each have to contribute 5.95% of your.

CPP reform Talks heat up ahead of ministers meeting CTV News, The canada revenue agency (cra) recently announced significant updates to the canada pension plan (cpp), effective january 1, 2025, as part of phase. Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum contribution will be $3,867.50 each — up from $3,754.45 in 2025.

DIY Tutorials WordPress Theme By WP Elemento